As expected, the Federal Reserve raised the federal funds rate by 0.75% to the 3.75-4% range on Wednesday. This was the fourth successive 0.75% hike. The initial market focus was on a new line inserted in the official statement, wherein the Fed nodded in the direction of decelerating the pace of rate hikes. Markets reacted positively to this, but Chair Jerome Powell was quick to remind investors that the level of rates matters more than the pace to get there. And Fed officials think the level (or “terminal rate”) should be higher than what they thought it should be in September. That immediately sent stocks into sharp negative territory.

- The Federal Reserve raised rates by 0.75% for the fourth consecutive time.

- The Fed nodded in the direction of decelerating the pace of rate hikes, but rates are likely to keep climbing.

- Some stock market weakness after a huge October is normal, but November is still a strong month historically.

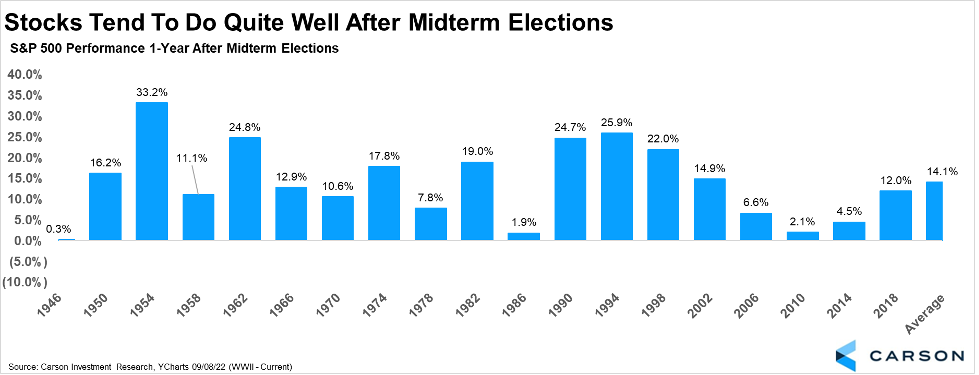

- Stocks have been higher a year after midterm elections ever since World War II.

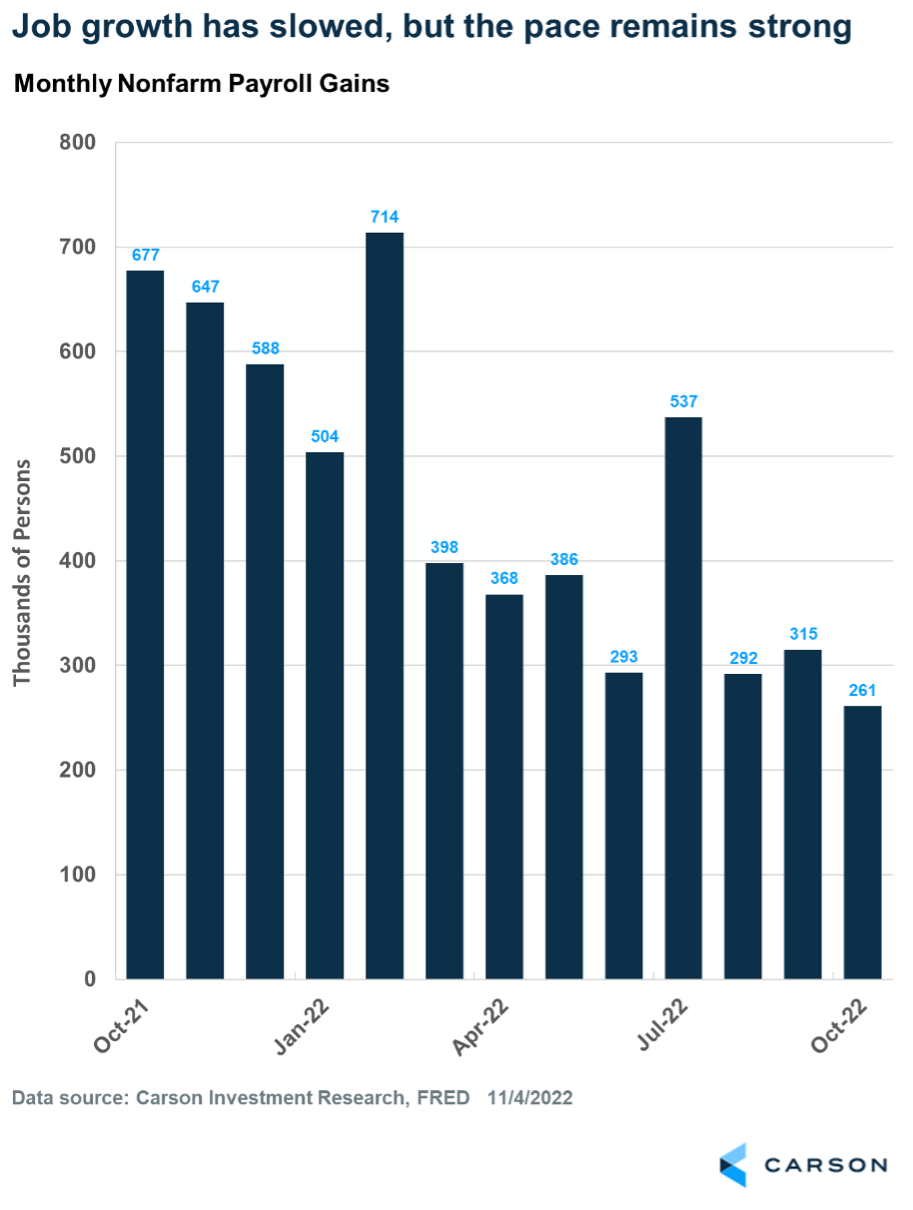

- The employment picture remains strong, with 263,000 jobs created in October.

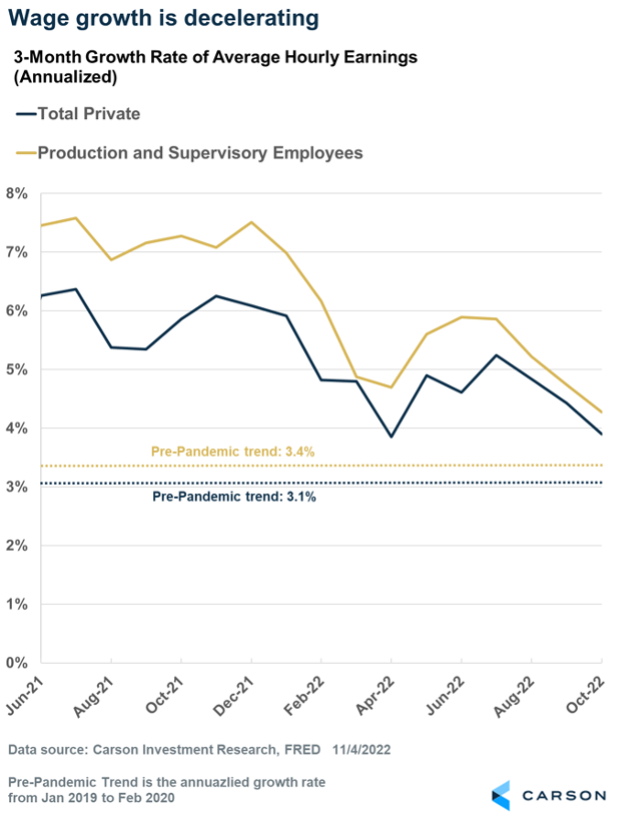

- Wage growth is slowing, and that should ease the Fed’s concerns about wages driving persistent inflation.

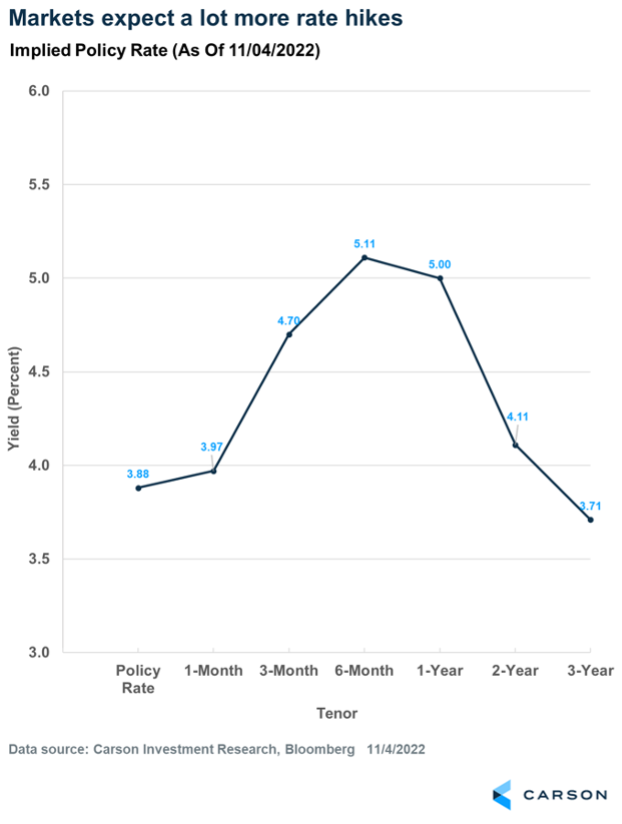

However, none of this was new news. Fed members projected the terminal rate to be around 4.6% at their September meeting, and markets were quick to price that. Then, in mid-October, a hot inflation report sent expectations even higher. Expectations for the terminal rate crept up to above 5% prior to last week’s meeting, and they haven’t moved much since then, even after Powell’s comments. Investors are clearly ahead of the Fed now, as they expect updated terminal rate projections at the Fed’s December meeting to come in around 5-5.2%. All in all, we’re probably looking at another 1-1.25% worth of rate increases over the next four to six months. But the Fed may very well slow the pace down, perhaps raising rates by “only” 0.5% at its December meeting.

Midterm Elections are Here

As the midterm elections have approached, we’ve received numerous questions on the potential impact. On the Carson Investment Research team, we encourage clients not to mix politics with investing. We know that investors who stayed out of the markets because they disliked previous administrations missed out on significant gains.

As past elections have shown, the party that lost the prior presidential election is typically more motivated and gains seats in the Senate and House. Should this pattern hold again and the Republicans take both chambers of Congress, stocks will likely benefit as divided government bodes well for the markets. A Democratic president and Republican-controlled Congress has seen the S&P 500 gain more than 16% on average during the calendar year. This occurred in the late 1990s under President Bill Clinton. If the Democrats keep control of the Senate, the market impact is about a coin flip. But the good news is a Democratic president with a split Congress is also a bullish scenario.

The overall picture, and good news, is the year following a midterm election has been positive in 20 out of 20 years since WWII, with an average return of 14.1%. While it is not guaranteed to happen again, the outlook based on history is positive.

The Carson Investment Research team recently chatted with Libby Cantrill from PIMCO on the firm’s new podcast, Facts vs Feelings. Libby is an expert who helps investors understand the intersection of politics, policy, and markets.

A Tale of Two Employment Reports

The October payroll report offered a mixed picture. Two headline numbers stand out:

- Nonfarm payrolls rose by 261,000, which was more than an expected increase of 200,000.

- The unemployment rate rose to 3.7%.

The first headline suggests that employment is strong and the economy is resilient to higher interest rates, so far. That means we could see the Fed push interest rates even higher than what’s currently expected. The logic: strong employment = higher incomes = more spending = persistent inflation, and so more rate hikes are needed to reverse this process.

The second headline suggests the labor market is weakening. That means the Fed should be on track to pause soon, as weak employment should eventually result in lower inflation.

What’s important to understand is the two headline numbers come from two different employment reports.

The so-called “establishment survey” is where the nonfarm payrolls data (along with hours worked and wages data) come from. It’s a survey of about 131,000 non-agricultural businesses and government agencies, representing about 670,000 worksites.

The other survey is the household survey, and that is where the unemployment rate comes from, along with several other ratios, including the labor force participation rate and the employment-population ratio. It’s a survey of about 60,000 households and gathers information on employment, unemployment, and other labor-force-related data (age, education, part-time/full-time jobs, etc.).

The household survey is smaller than the establishment survey, and as a result the numbers tend to be more volatile. It also tends to be more useful to track ratios such as the unemployment rate, and another advantage is it doesn’t get revised. The establishment data can get revised, and we’ve seen large revisions to payrolls in the past, often months or years later.

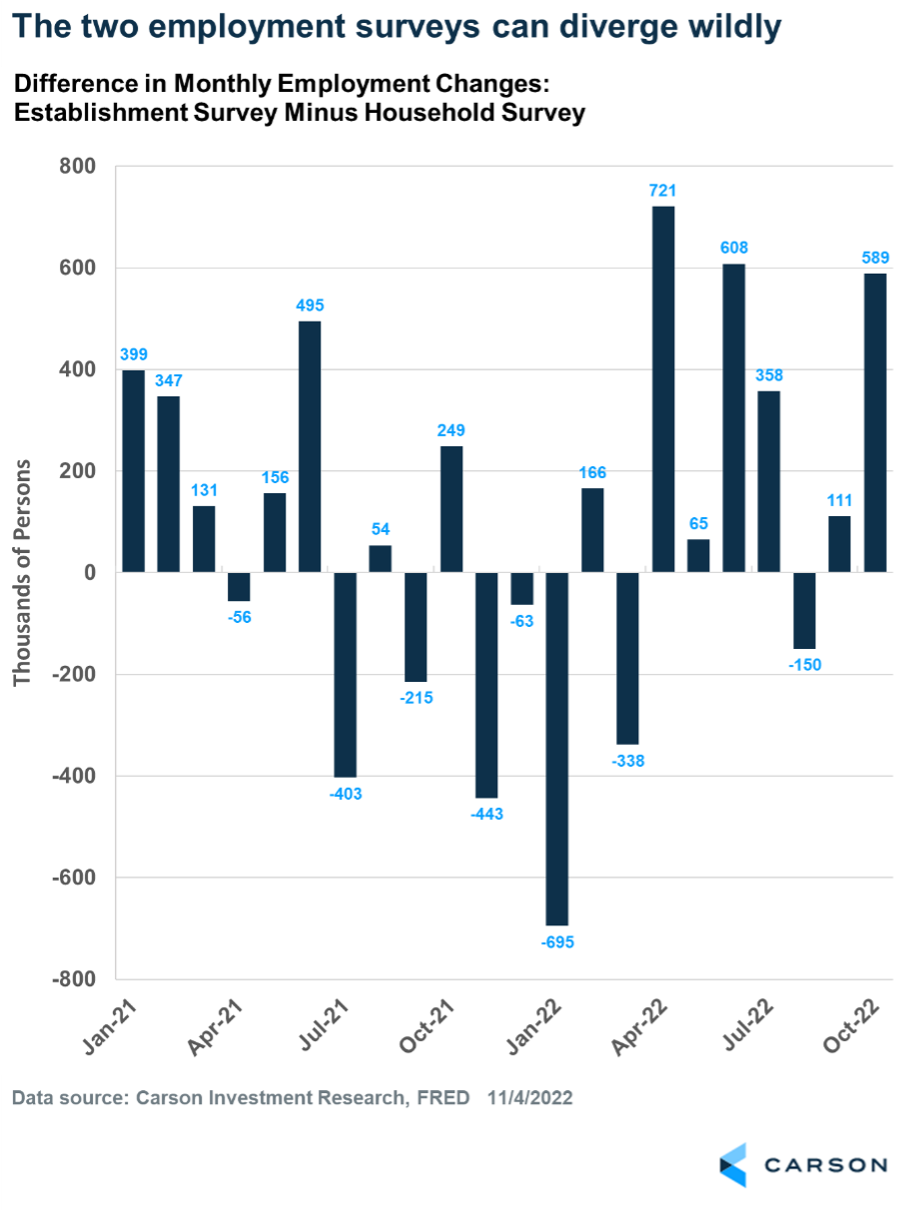

In the October report, the unemployment rate rose because the household survey showed the number of unemployed persons rose. The survey also showed the number of employed workers fell by 328,000, which is completely opposite of what the establishment report showed (+261,000). That’s a massive difference of almost 600,000. But this is not unusual, as the chart below illustrates.

As the chart shows, the difference between employment gains reported by the two surveys was larger in April and June of this year. In April, nonfarm payrolls rose by 368,000, while the household survey reported employment fell by 353,000. In June, nonfarm payrolls rose by 293,000, but the household survey saw employment falling by 315,000. It goes the other way, too. In January, the household survey saw employment rise by 1.2 million, while nonfarm payrolls rose “only” 504,000.

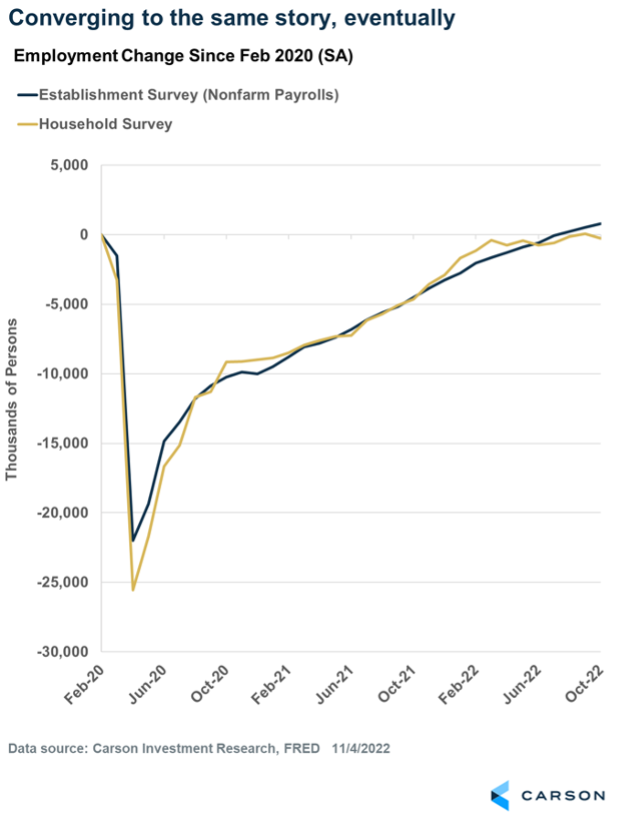

However, both surveys reveal a similar picture over time.

Over short periods of time, one survey can accelerate much faster than the other. During the height of the pandemic (Mar-Apr 2020), the household survey reported significantly more job losses than the establishment survey: 25.5 million vs. 22 million. But the household survey caught up and even ran ahead of the establishment survey through January of this year. Now the establishment data is powering ahead while the other slows.

So, is the job market weak or not?

That’s the big question. Given the volatility of the numbers in the household survey, I tend to put more weight on the establishment data, with the caveat that establishment payroll data can be revised, although markets (and the Fed) react to current data.

A more nuanced view is the employment situation is clearly slowing. But 261,000 jobs created in a month is still very strong. In fact, over the 20 years through 2019, a period that covered two economic expansions, the average monthly job gains in months when payrolls grew was about 182,000. And over the three years prior to the pandemic (Mar 2017-Feb 2020), payroll growth averaged about 186,000 per month.

Now, the unemployment rate has increased to 3.7%, but one month does not make a trend. The same thing happened in August when the unemployment rate rose from 3.5% to 3.7% before falling back to 3.5% in September.

What Matters (to the Fed) is Wage Growth

A key piece of information in the payroll reports is average hourly earnings. This is the mechanism through which the Fed believes it can (and needs to) pull down inflation. From the Fed’s perspective, weakening the labor market will reduce income growth, and that should ultimately reduce spending power and inflation.

Wage growth is in a clear downtrend. Average hourly earnings ticked slightly higher for private workers last month, but over the past three months it’s grown at an annualized pace of 3.9%, well below the past year’s pace and not much above the pre-pandemic pace of 3.1%. In fact, for production and non-supervisory workers, who tend to spend more of their incomes, the three-month pace of wage growth has fallen to 4.3%, down from 7.5% at the end of last year and approaching the pre-pandemic rate of 3.4%.

The good news is wage growth appears to be slowing even as employment remains strong. This is the “soft landing” scenario: wage pressure and inflation easing without a breakdown of the labor market, which runs counter to what the Fed believes will (and should) happen. Hopefully, easing wage pressure means the Fed doesn’t have to ratchet rates higher and higher. We just need inflation to cooperate, and that depends on a lot more than wages.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

Compliance Case # 01543039